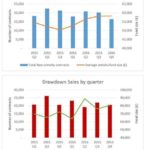

Two years since the Government’s pension flexibility reforms came into effect, the majority of savers with larger pots are using them to buy a retirement product – either a guaranteed income (annuity) or flexible income (drawdown). The sum being withdrawn when a pension pot is taken as one lump sum the first time it is accessed has fallen to an average of £14,000. The level of activity remains high with around 170,000 pension pots being accessed for the first time during the second and third quarters of 2016 and 82,100 new products being sold. This compares with 87,500 […]

Full Post at www.actuarialpost.co.uk