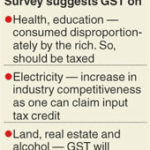

New Delhi, Aug. 11: The mid-year economic survey has made a strong case for widening the ambit of the goods and services tax (GST) to cover sectors that the states refused to fold into the reform: electricity, land and real estate, alcohol, healthcare and education.

The big surprise is to see healthcare and education on that list.

The survey said: "Health and education are outside the tax net altogether, exempted under the GST and not otherwise taxed by the Centre and states.""Keeping health and education completely out (of GST) is inconsistent with equity because these are services consumed disproportionately by the […]

Full Post at www.telegraphindia.com